Chapter 2 Net Income Lesson 2.5 Group Health Insurance Answers

WB Page 20 2-2. Section 2-2 Practice.

Section 2 5 Pp Group Health Insurance Ppt Download

The annual cost of Nadines family.

. Federal Tax 70 State Tax. 16800 45 P a g eUse the Social Security Tax Rate of 62 of the first 90000 and Medicare. What is his weekly state income tax.

118 Chapter 2 Net Income Some companies use a percentage method instead of the tax tables to compute the income tax withheld. Kelsey Olson is a chiropractor with an office in lancoln City. She pass the following weekly salaries to her three.

Calculate the deduction for group health insurance. Make sure you use notation in your answer Example 1000. Johnathan earns 72500 per year.

Federal income tax is charged as follows. Net Income Chapter 25 Group Health Insurance Objectives. Use Figure 21 to find the amount withheld for the single.

Deduction per Pay Period Total amount paid by employee Number of pay periods per year. What amount will be withheld from his paycheck for FIT. 1043 52 2006 e.

142 READ and do 1-9 ODD 15-21 ODD 26. This amount articulates with the amount of net income in the income statement because net income is added to the. Use the FIT table to find the.

Find the amount the employee pays Step 3. Pages 132-134 Examview password. 3100 Earnings to date.

Applied Chapter 2 Book - Net Incomepdf - Google Docs. Thing have changed at Ozark Construction Company. Tom Neimans gross pay for this week is He is married and claims 2 allowances himself and his wife.

15 on the first 48535 of taxable. 139 READ and do 1-9 ODD 13-23 ODD 25 SOLUTIONS PART 12 Lesson 26 Statement of Earnings - Pg. 350 Earnings to date.

2-2 State Income Tax Print. Kim Choi pays 11580 per month for group medical insurance. Health insurance offered by many businesses to employees paid in part by the business and in part by the employee.

They are responsible for the financos M ayroll take and recording Chapter 2 Dr. How much does he take home per week after taxes. The end-of-year balance of owners equity in the balance sheet is 85000.

Lesson 25 Group Health Insurance - Pg. Amount you have leftover after all tax with-holdings and personal exemptions have been. Taxable Income 32000 2200 29800 d.

Deduction per Pay Period Total. Find the deduction per pay period Example 2.

Chapter 2 Net Income 2 1 Federal Income Tax Fit Federal Income Tax Is Money Withheld By Employers Tax Table On Pg 790 Carlas Gross Pay For This Course Hero

Income From House Properties Exemption Relief And Practice Questions

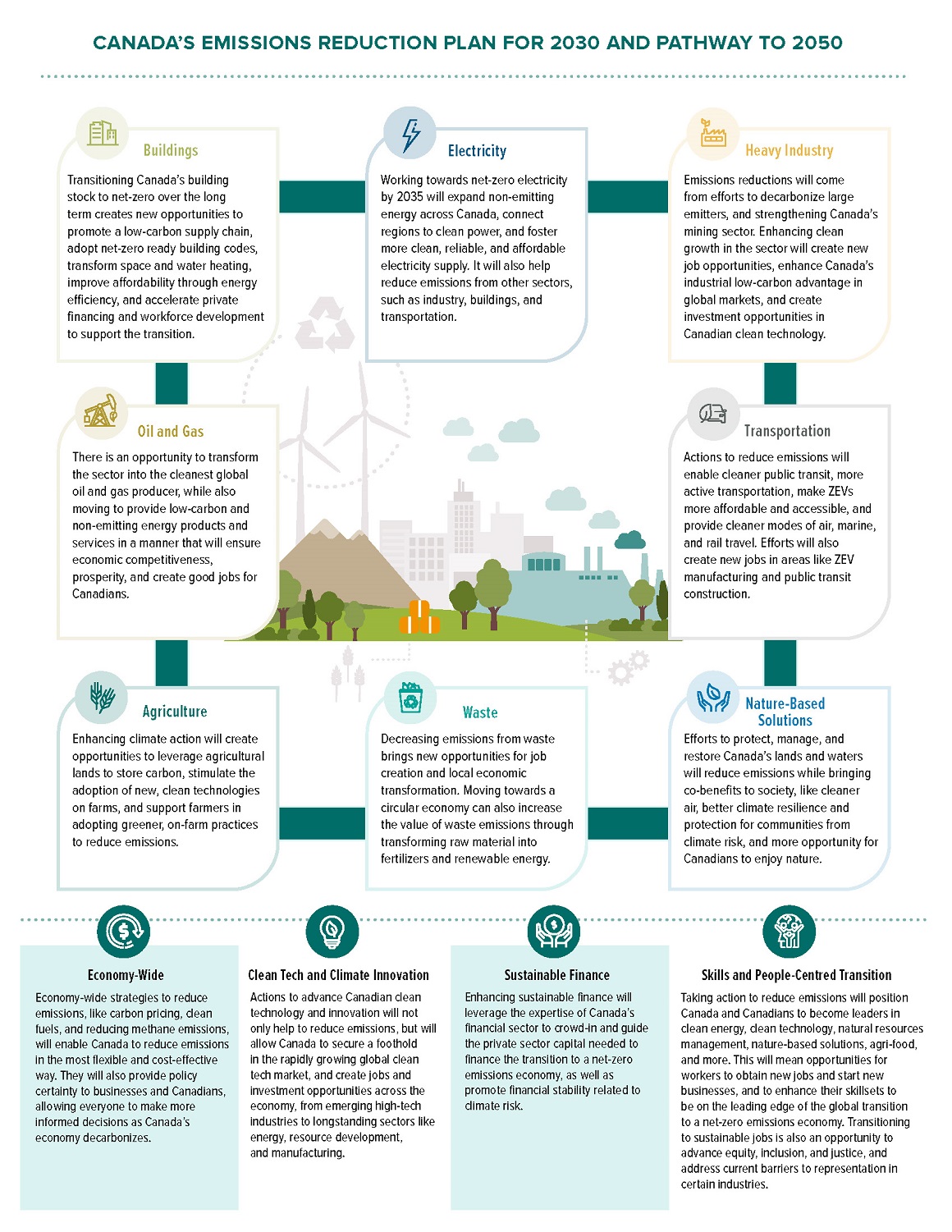

Canada S 2030 Emissions Reduction Plan Chapter 2 Canada Ca

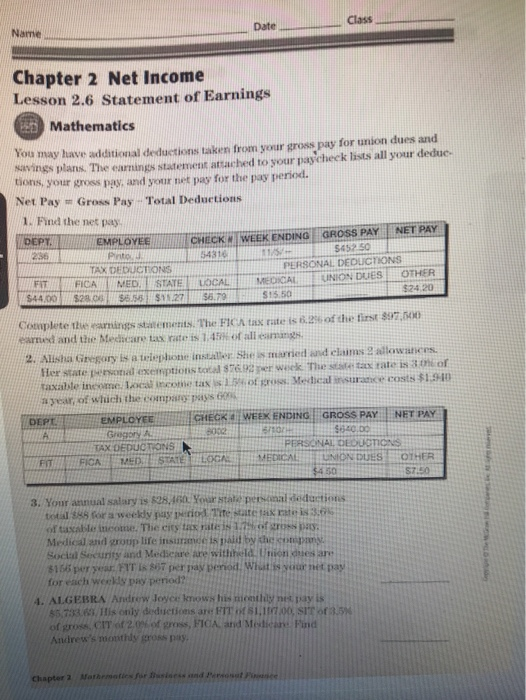

Class Date Chapter 2 Net Income Lesson 2 6 Chegg Com

Full Article Who Cares About Sanctions Observations From Annual Reports Of European Firms

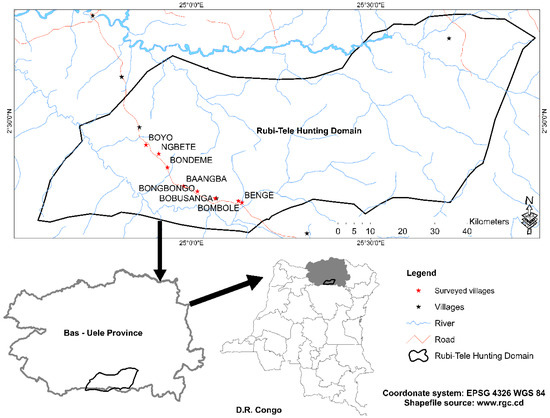

Forests Free Full Text Assessing The Economic Contribution Of Forest Use To Rural Livelihoods In The Rubi Tele Hunting Domain Dr Congo Html

Section 2 5 Pp Group Health Insurance Ppt Download

Chapter 2 Net Income 2 1 Federal Income Tax Fit Federal Income Tax Is Money Withheld By Employers Tax Table On Pg 790 Carlas Gross Pay For This Course Hero

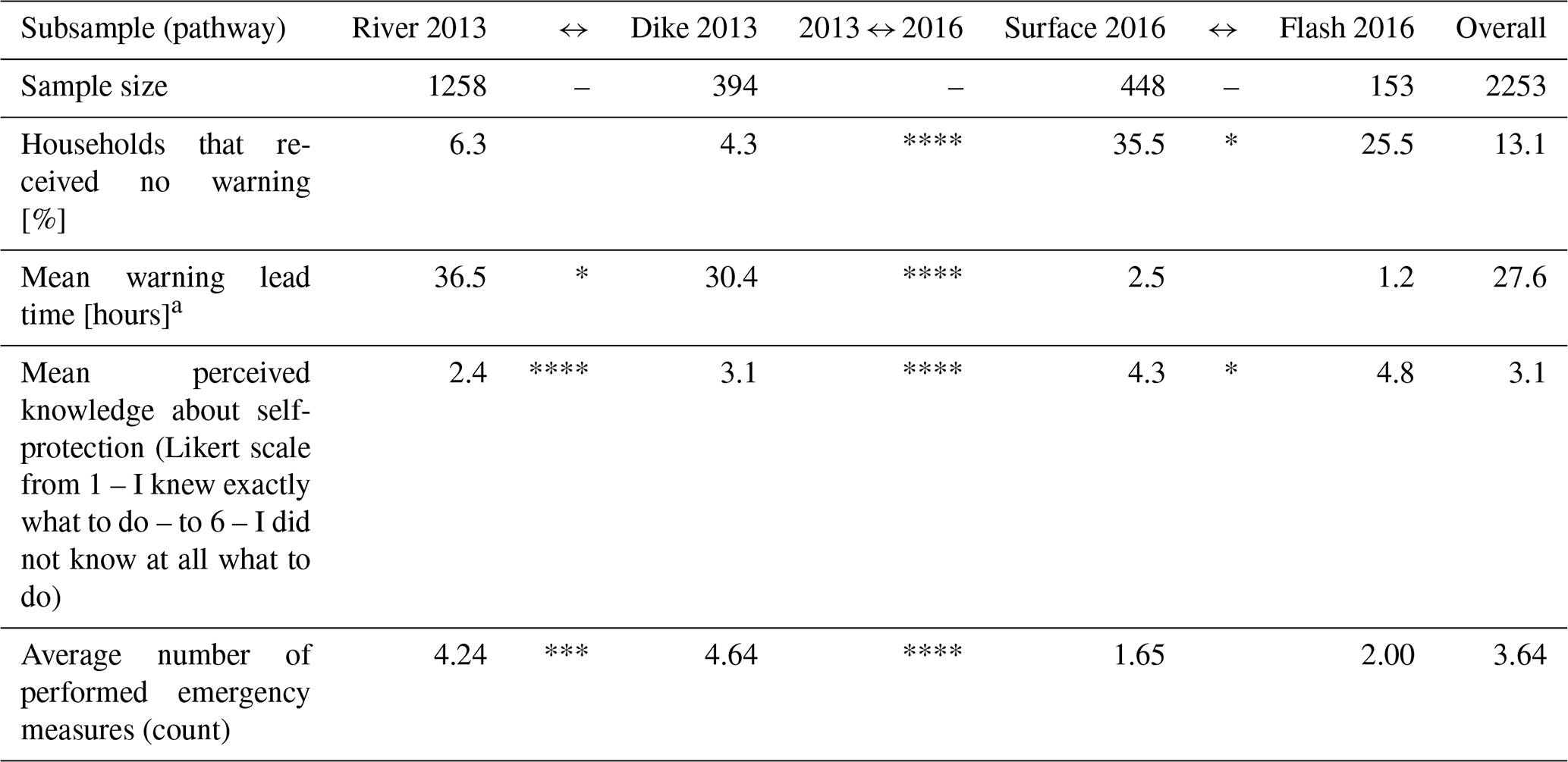

Nhess Compound Inland Flood Events Different Pathways Different Impacts And Different Coping Options

Links Between Growth Inequality And Poverty A Survey1 In Imf Working Papers Volume 2021 Issue 068 2021

Connecting Systems Of Secondary Cities

Coronavirus Outbreak Live Updates On Covid 19 Modern Healthcare

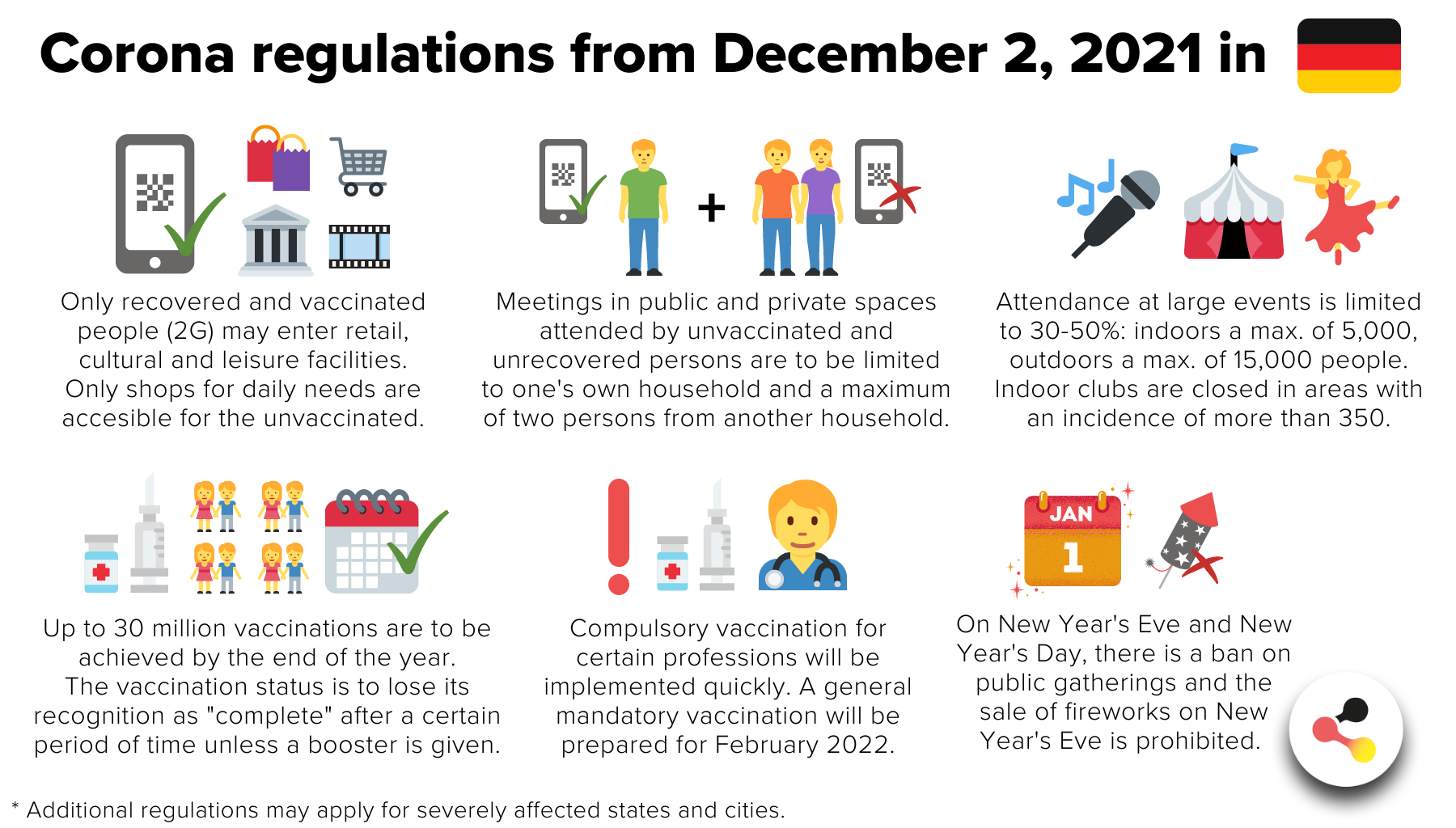

Corona Germany Measures Of The Federal Government

Can Celebrities Set The Agenda Anthony J Nownes 2021

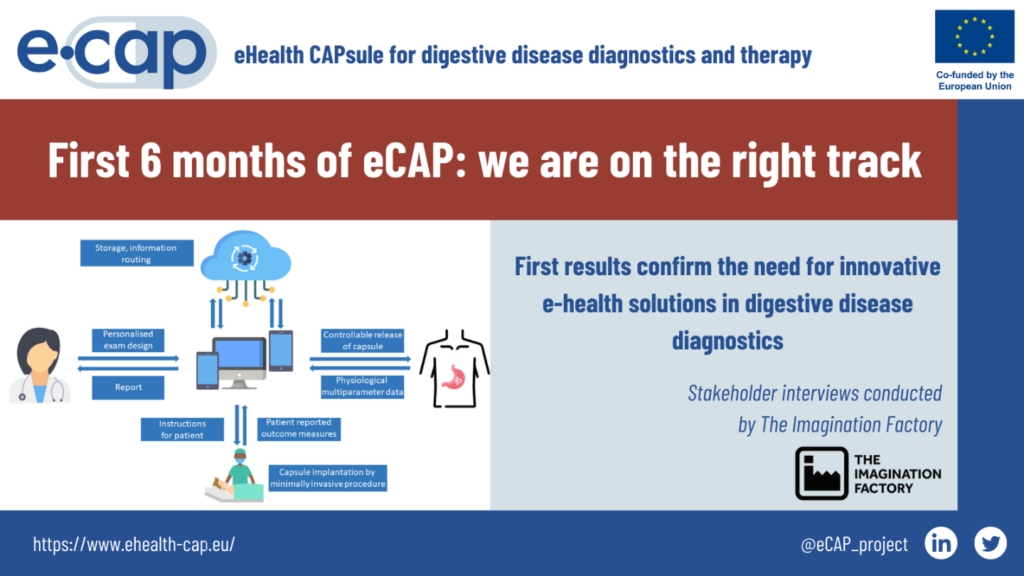

News Amires

424b4

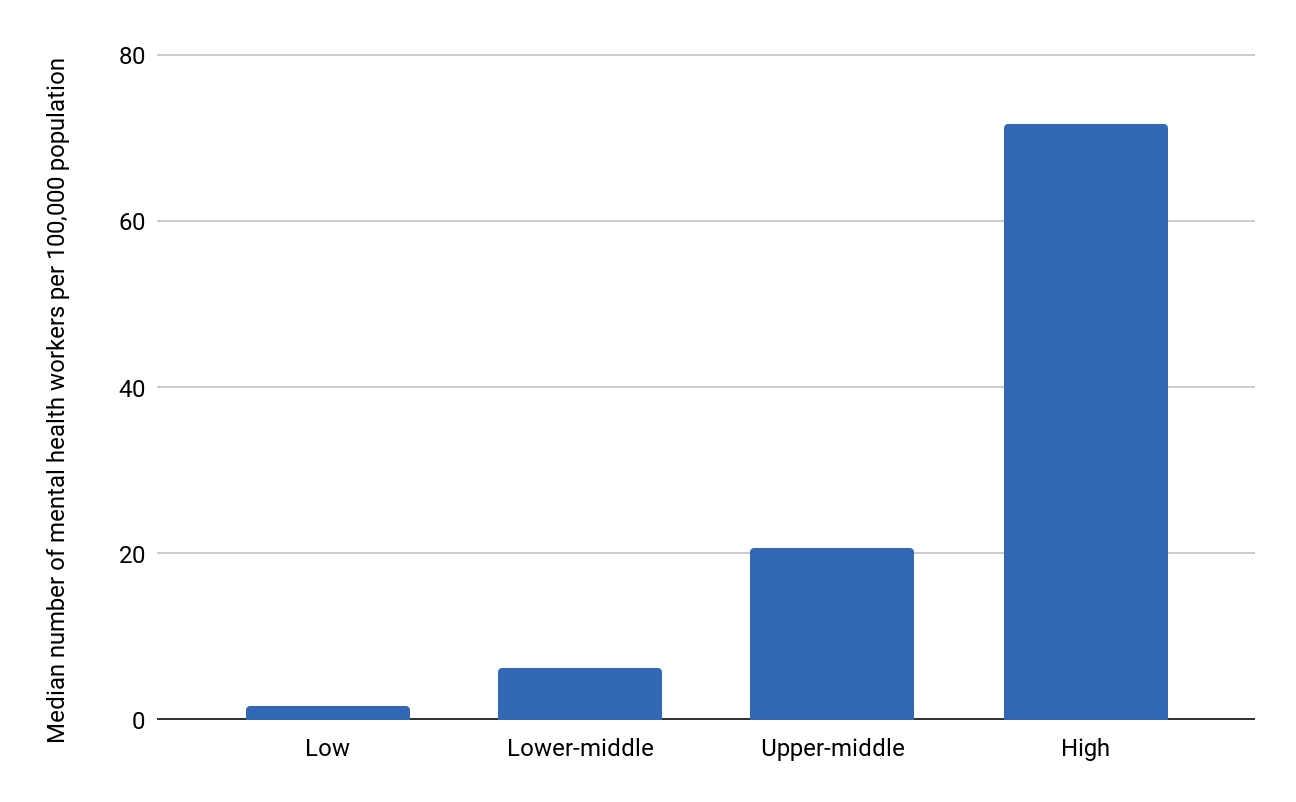

Global Priority Mental Health Happier Lives Institute